From the very beginning, copper has been considered one of the world’s most essential and valuable commodities due to its durability and use in various industries and products.

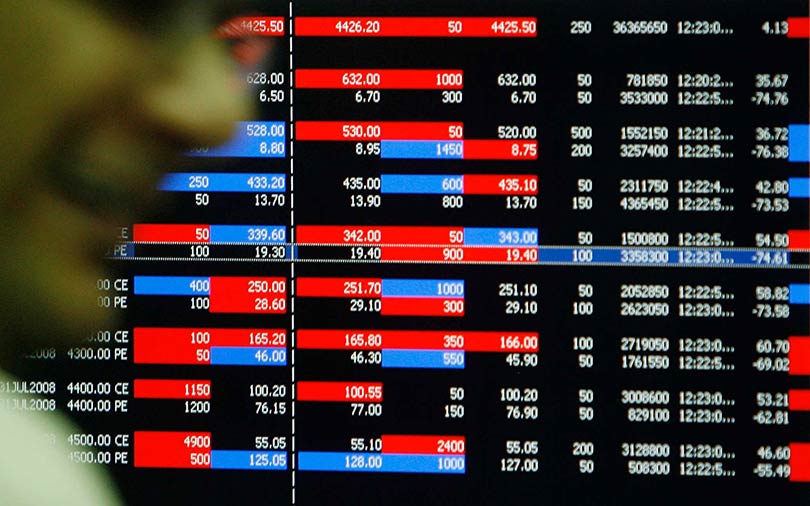

Before we begin, it’s important to note that when we talk about copper trading in India, we refer to the buying and selling of copper futures on the Multi Commodity Exchange (MCX). It’s also important to note that copper trading on the MCX silver involves commodities trading with real money. So be sure you do this with caution and risk management techniques in mind.

With that out of the way, let’s dig into everything you need to know about India’s MCX copper trading system, including the MCX commodity trend today.

What is The MCX Copper Trading System?

The Multi Commodity Exchange of India (MCX) is a stock exchange that trades numerous commodities, including crude oil, gold, silver, base metals like copper and aluminum, and energy products. The commodities traded on MCX are relatively less risky than those sold on commodity futures exchanges. An investor can enter into various derivative instruments, including forwarding contracts and options on these commodity products.

How Does It Work?

The MCX copper trading system facilitates two-party trading of specific commodities at set prices. On one side, there’s an investor who wishes to gain exposure to a commodity. On the other side, there’s an end-user who wishes to buy or sell physical goods for consumption or sale. Once a contract is signed, both parties need to perform their obligations. If an end-user doesn’t have enough product when it’s time to deliver, they can borrow from another party (subject to interest). If they don’t have money in hand when it’s time to pay up, they can purchase performance bonds.

How To Trade Copper On MCX?

One can learn how to trade copper on MCX by first looking at an MCX copper chart representing price trends and comparing these charts with daily prices. Observing price trends will enable you to understand what signals are present when it comes time to make trades. When price action moves up, it indicates a bullish signal which means it is probably a good idea to sell your holdings because the price could continue to rise even further. For a beginner trader, like most other types of trading, one needs to have patience and a willingness to take risks to avoid losing money while trying out different strategies.

Best Times To Trade Copper On The MCX Exchange

In most cases, copper tends to be a solid investment during periods of slow economic growth. This is because copper is a fundamental building block of construction and manufacturing. When economic times are tough, people tend to invest more in things that help them keep costs down. As a result, demand for copper increases. Other economic factors also affect how investors trade on MCX’s commodities exchange. But overall, investing based on economic trends makes sense for many products.

On top of everything, doing two things can help you make the right decisions. First, take the help of an MCX copper chart, and second, find the answer to the question; what is the MCX commodity trend today?

The Price and Demand For Copper

Demand for copper and prices are closely linked, meaning that when demand is high, so is price. And when there’s less demand, costs also go down. This information can be used to your advantage as a trader. If you see prices start to drop because of low demand, it might be worth buying up stocks of copper before prices increase again, especially if you think the growing global market will push them back up. On the other hand, if you see that supply has increased while demand hasn’t kept pace (or vice versa), it might make sense to sell some shares or avoid buying altogether until those numbers reach equilibrium.

The Bottom Line

The most traded commodity in MCX is copper, followed by crude oil, natural gas, and gold. The global copper market is worth $50 billion, making it a lucrative market for traders who are willing to take a risk. To trade commodities or futures, you should know all about it right from where to start, which strategy will be best suited for your investing needs and expectations, and not to mention being updated with the latest MCX commodity trend today.